The Straits Times Index: Record Highs or Running Out of Steam?

(This article is published bilingually, with the 中文版 following the English edition)

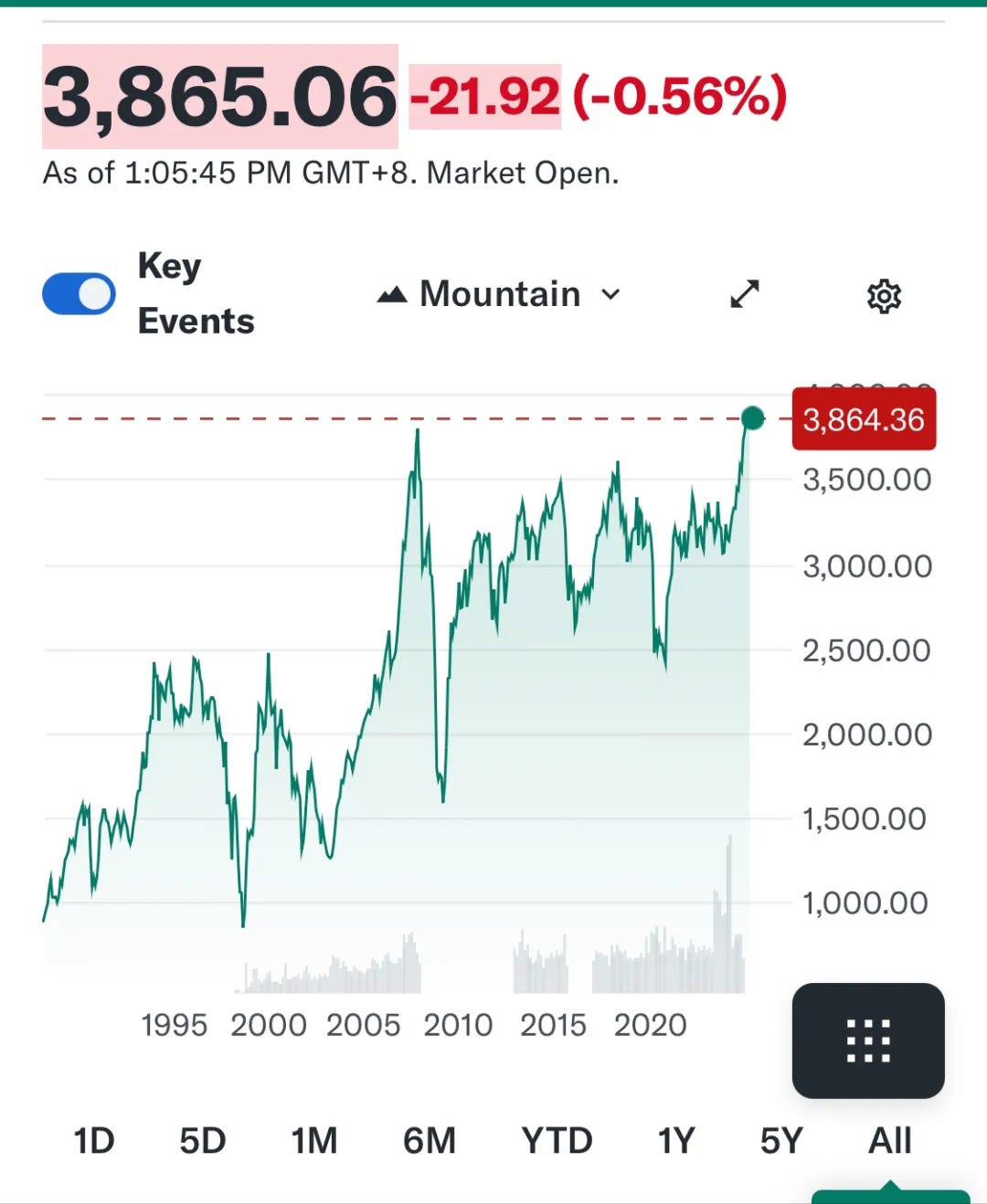

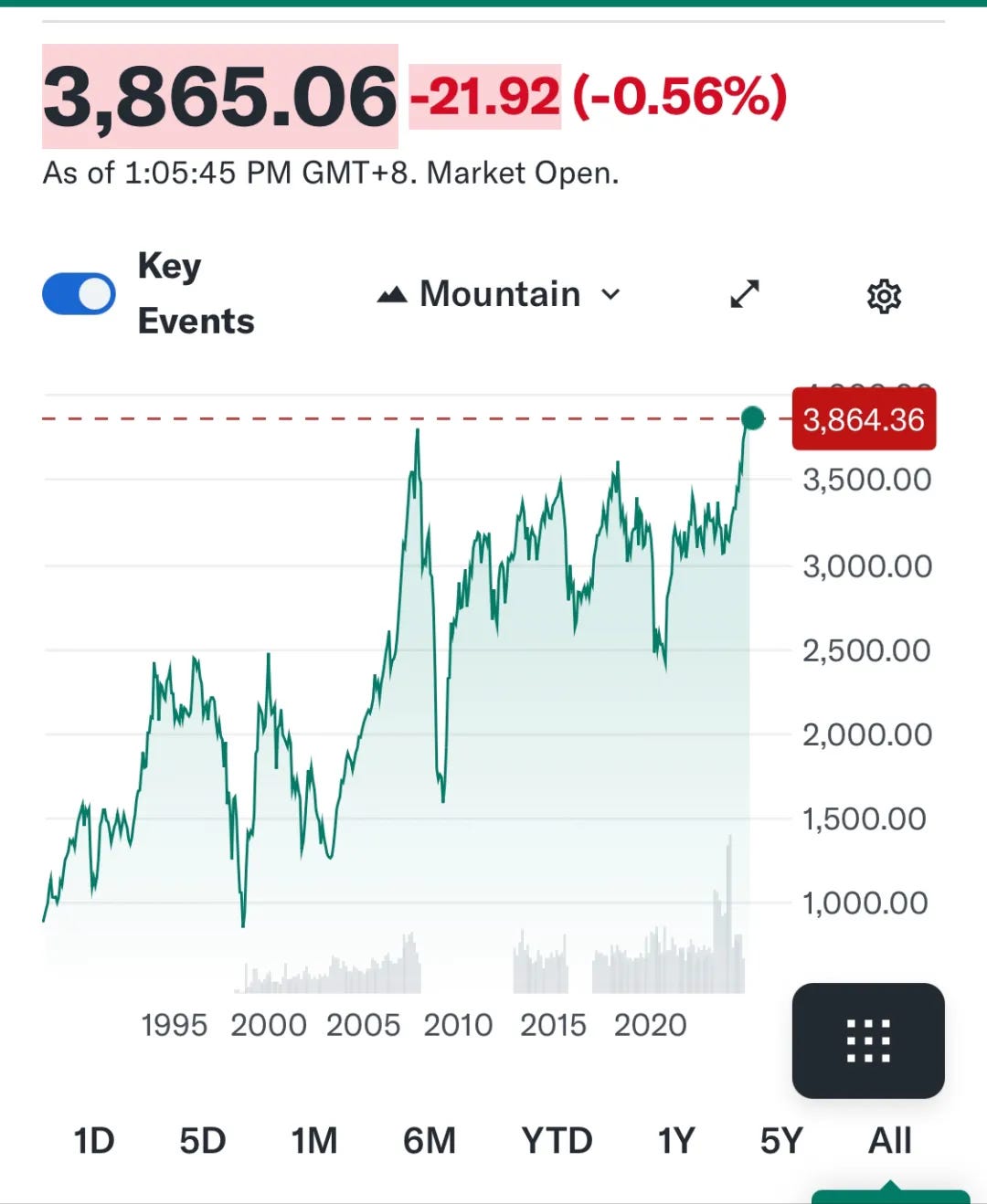

January 8, 2025, will go down in history as the day the Straits Times Index (STI) reached a record high, closing at 3,886.98 points. But before we pop the champagne, here’s the other half of the story: the last time STI peaked wasn’t last week, last month, or even last year—it was way back in October 2007, almost 18 years ago. The global financial crisis of 2008 sent the STI plummeting to around 1,400 points. Since then, it’s spent most of its time bouncing around the 3,000-point mark. Turns out, the "3,000-point defense" isn’t just a China A-shares trope.

Meanwhile, in the Land of S&P 500…

For perspective, the S&P 500 sat around 1,500 points in September 2007. Yes, it was nearly halved during the 2008 financial crisis, but today? It’s flirting with 6,000 points. Without even counting dividends, the 18-year total return is close to 300%. Ouch, STI.

A Very Peculiar Index

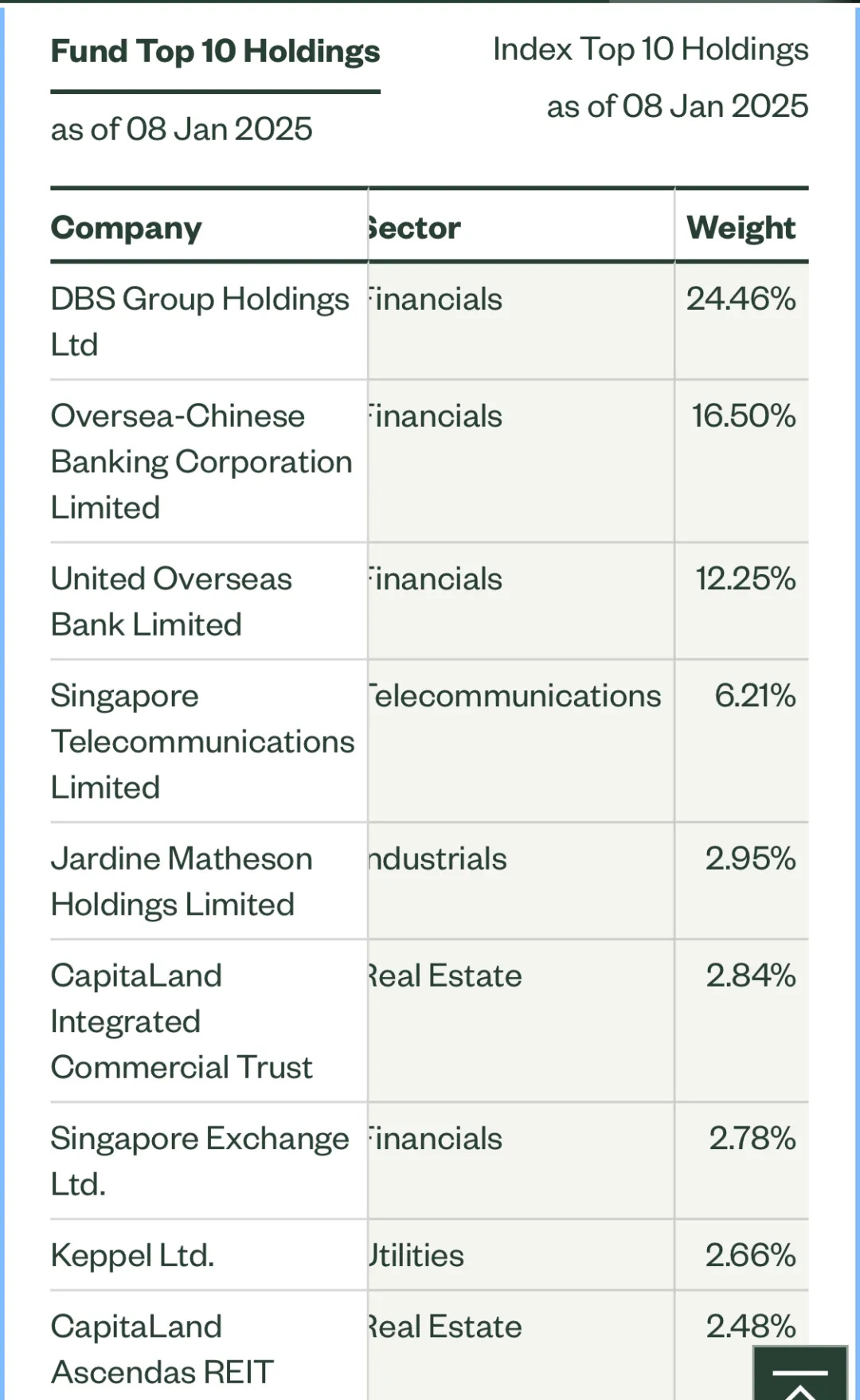

The STI is a unique beast. First, it’s tiny. The S&P 500 has—surprise—500 constituents, and the Hang Seng Index has 83. STI? Just 30. With over 600 securities listed on the Singapore Exchange (SGX), that means only 5% make it into the STI.

Too Many Eggs, Not Enough Baskets

What’s more, the STI is top-heavy. Singapore’s three major banks alone make up over 50% of the index. Throw in Singtel, the largest telco, and the top four stocks account for nearly 60%. And because the three banks’ share prices are closely correlated, diversifying into the STI often just means you're buying bank stocks. For every $10,000 you invest, over $5,000 goes to banks. Diversification, this is not.

Banks on the Rise

Unsurprisingly, the STI’s recent climb has been powered by the banks. Thanks to rising interest rates and a surge of safe-haven funds, local bank stocks have doubled since the pandemic’s early days. Meanwhile, other index components have mostly languished. About 15–20% of the STI consists of real estate investment trusts (REITs), which have been pummeled by rising interest rates, dropping 20–30% over the past couple of years.

A Quiet Market

Singapore’s stock market is, well, sleepy. Average daily trading volume on the SGX hovers around S$1 billion, compared to the Hong Kong Stock Exchange’s HK$100 billion. That’s a 15x difference.

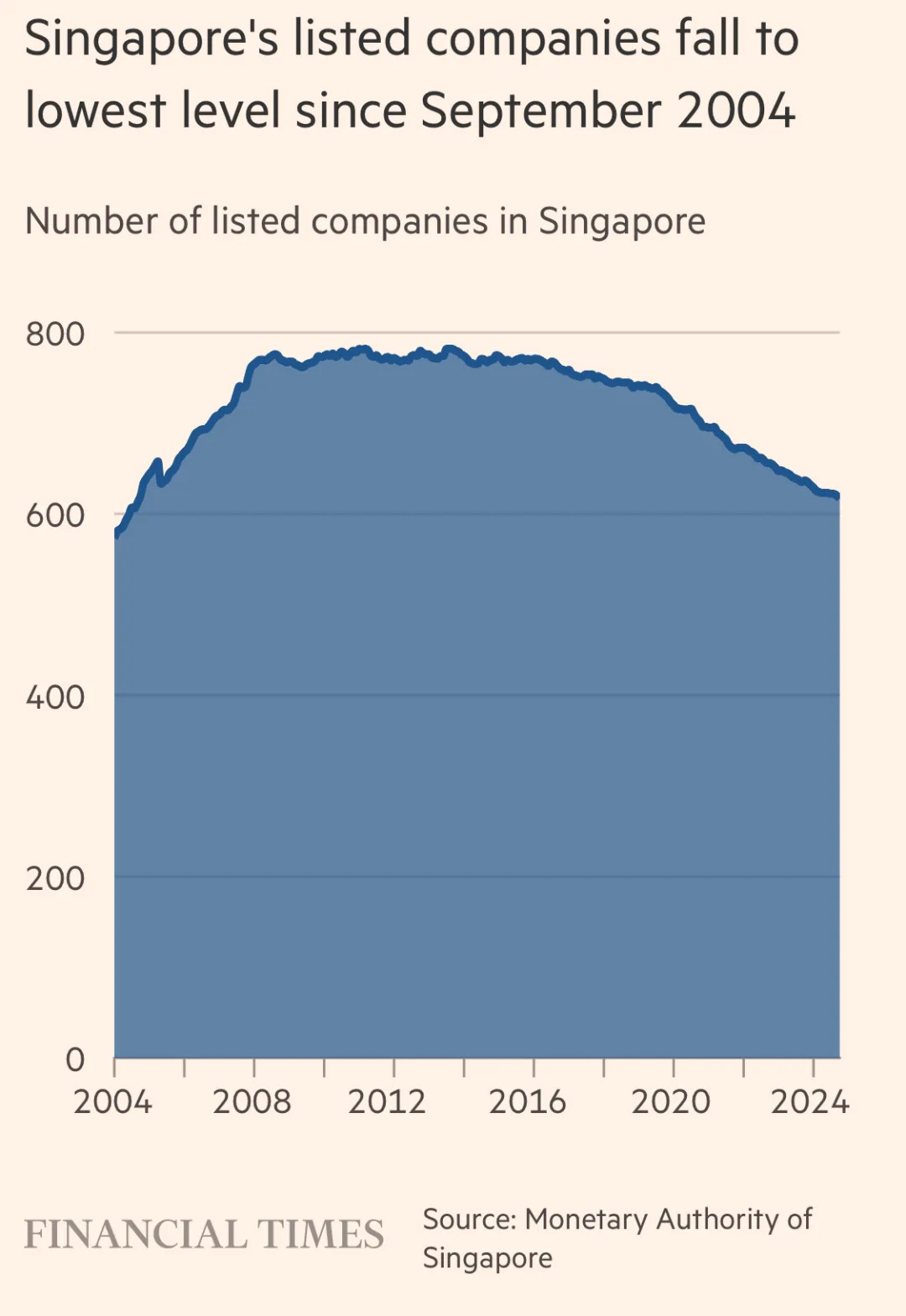

Few IPOs, Shrinking Listings

New listings are rare in Singapore. In 2024, the SGX had just four IPOs. Worse, the total number of listed companies has been steadily declining, hitting a 20-year low. Even local tech giants like Grab and Sea opted to list elsewhere.

Rebuilding the Market

In response, Singapore’s central bank MAS formed a task force last year to revive the SGX. Their report, due in August, might shed light on how they plan to make the local stock market "great again."

Why Singapore Stocks Still Matter

Despite the challenges, Singapore stocks still have their merits, especially for residents.

Dividends Are King: While the STI has been sluggish, dividends have been generous. Current dividend yields exceed 4%, with many battered REITs offering yields over 6%. For income-focused investors, this is gold.

No Dividend Taxes: Singapore doesn’t tax dividends. If you invest in U.S. stocks, dividends are taxed at 30%, or 15% via Ireland ETFs. A 4–5% post-tax dividend yield from Singapore stocks is globally competitive.

No Currency Risk: Investing in Singapore stocks shields residents from currency risks. The Singapore dollar (SGD) has historically appreciated against most currencies, including the USD.

Reasonable Valuations: Despite the record high, the STI’s price-to-earnings (P/E) ratio is around 15, which is fair. While bank stocks have doubled, their growth has been underpinned by solid fundamentals, not just rising rates. REITs, on the other hand, remain deeply undervalued.

Estate Planning Simplified

There is one more often-overlooked advantage: settling estates. For Singapore residents, inheriting locally-listed stocks is far simpler than navigating the complexities of foreign holdings.

A Practical Option for CPF and SRS Accounts

As I mentioned in my CPF guide, if you’re dissatisfied with CPF interest rates, you can invest through CPF or SRS accounts. While these come with restrictions—directly buying U.S. stocks is tough—Singapore stocks are a reasonable fallback.

Just My Thoughts

As always, this is just a personal record of my thoughts, not financial advice. Investing involves risks. Proceed with caution!

(Disclaimer: This article was originally written in Chinese and translated into English by the almighty ChatGPT with manual editing. In case of any discrepancies, the original Chinese version should be considered the preferred source. Below is the Chinese version)

1. 2025年1月8日是个值得纪念的日子。这一天,新加坡海峡指数(STI)冲到了历史新高,报收3886.98点。当然,事情只讲了一半:上一次的高点,不是一周前,也不是两个月前,而是在2007年10月,距今将近18年。2008年次贷危机,海峡指数最低跌到了1400点附近。此后十多年,海峡指数一直在三千点上下横跳。3000点保卫战不只是A股的戏码

2. 作为对比,2007年9月的标普500大约是1500点,尽管标普500在2008年的金融危机中也接近腰斩,但今天的标普已经接近6000点,不算股息,18年总收益率接近300%

3. 海峡指数是个非常特别的指数。首先,其成分股非常少。标普500顾名思义有500只成分股,恒生指数有83只成分股,但海峡指数只有30只成分股。在新交所交易的证券有600多只,不算少,但就数目而言,仅有5%被选为海峡指数的成分股

4. 更特别的是,海峡指数的头部高度集中。本地三大银行,比重就超过50%。再加上本地最大的电信运营商新电信,这四只股票的比重就接近60%。而且,三大银行之间,股价相关性很强。买指数本意是为了投一篮子股票降低风险,但到头来每投一万块,有超过五千都买入了银行股

5. 这一两年海峡指数的攀升,主要也是银行股带动的。受益于升息和避险资金的涌入,本地银行股价格相比疫情初期已经翻倍。而指数的成分股其实不怎么涨。海峡指数大约有15-20%的房地产信托(REIT)。REIT是升息的受害者,这两年应该跌了有20-30%

6. 新加坡股市整体上都是死气沉沉的。这种不活跃首先反映在成交量上,新交所每天的交易额大概是10多亿新币。作为对比,港交所的每日成交额大约是千亿港币的级别。两者相差15倍

7. 也少有公司来新加坡上市。2024年,新交所全年仅有4个IPO,非常惨淡。更可怕的是,存量公司数也在一路下滑,达到了20年来的最低点。本地的互联网大厂,比如Grab和Sea,都没有选择在新交所上市

8. 正因为此,新加坡金管局去年专门成立了一个部长领衔的检讨小组,探讨如何重振新交所,让新加坡股市再次伟大。这个小组将在今年八月出报告,值得关注

9. 但是,我认为,尽管有以上种种局限,新加坡股票仍然有其价值,不宜全盘否定。尤其对于新加坡居民,新加坡股票仍然有独特的吸引力

10. 首先,尽管海峡指数不怎么涨,但是整体上分红挺乐观。目前的股息率应该是超过4%,这几年跌得很多的REIT,股息率很多都超过了6%。对于需要现金收入的投资者,这一点至关重要

11. 而且,新加坡不对股息征税,股息可以全部拿到手。如果投资美股,股息要收30%的税,即使通过爱尔兰ETF,股息也有15%。4-5%的税后股息率即使放眼全球,也是有吸引力的。如果投资美股的高股息ETF,在扣除了股息税以及考虑了汇率风险之后,要达到4%并不容易

12. 其次,新加坡居民投资新加坡股市,天然地就规避了汇率风险。从历史数据来看,新币不仅对美元长期是升值的,而且对几乎任何货币都是升值的。投资其他股市,都必须考虑这个风险

13. 再次,整体来说,新加坡股市尽管指数创新高,但是整体市盈率仍然在15左右的水平,相对合理。银行股虽然过去几年涨了一倍,但这种涨幅是有业绩支撑的。而且业绩的增长不全来自于升息,在财富管理上,本地银行最近几年也有不俗表现。而房地产信托仍然活在升息的阴影里,整体估值很低

14. 一个重要但经常被人忽视的问题是人去世之后,股票怎么办的问题。相对而言,新加坡居民在新加坡投资,取回逝者的资产,要相对简单一些

15. 在介绍CPF的文章中,我提到过如果对公积金的利率不满意,政策也允许自己投资。但这种投资相对限制较多,比如很难直接买美股。这时候与其买各种乱七八糟的基金、保险,投资新加坡股票算是不得已的次优选择。SRS账户也类似

16. 一如既往地,本文只是自己个人的想法的记录,任何时候对不构成投资建议。投资有风险,入市须谨慎